The Economic and Investment Cycle is very critical to understand and work with when developing a financial strategy and budget.

The Economic and Investment Cycle is very critical to understand and work with when developing a financial strategy and budget. Everyone is impacted by the movements in the world economy. Changing real estate prices and interest rates impacts everyone whether you like money or not.

Not understanding the economic cycle and making investment decisions at the wrong time can adversely impact on your long-term financial goals. Some people will say they don’t care what’s happening in the economy. For example, they want to buy or sell a house now. They don’t assess whether the property market is good or bad for buying and selling. Ignoring the economic cycle could cause you to pay much more when purchasing a home or sell in a depressed market, losing considerable money.

Economic & Investment Cycle Knowledge

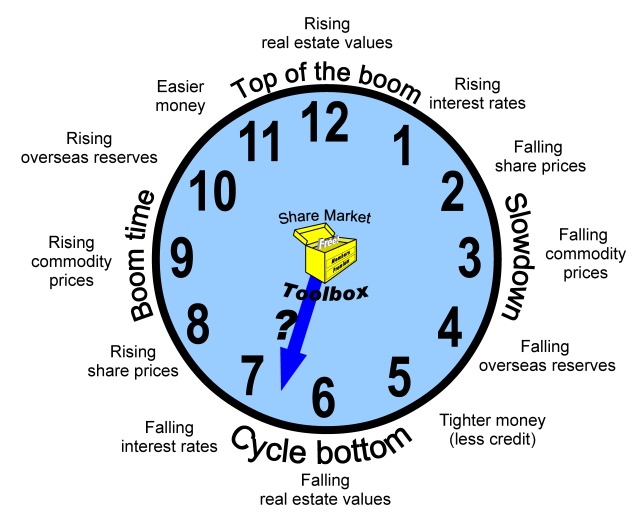

The economy moves in a cycle through various stages from peak to trough and back again. It is very important to recognize where we are in the economic cycle before you make any investment decisions.

Please be aware that the economic cycle does not flow around in a nice uniform circle. The economy can move with uneven motion. Sometimes a recession can hit quickly but the economy recovers quickly. Other times a recession can hit quickly but the economy take years to recover. Some economies (like Japan) remain in recession for many years and take decades to recover.

Economic & Investment Cycle Actions

Here is the Economic and Investment Cycle and what action should be taken to maximize the investment return from each phase of the cycle.

Obviously, when the real estate market peaks it’s the best time to sell real estate. There are a high volume of property transactions and real estate sells quickly generating high prices.

The best time to buy real estate is at the bottom of the cycle when the property market is depressed and there is a low volume of property transactions, Sellers have difficulty selling their property for a good price. Properties can be listed for many months before being sold.

With most consumer goods, the best time to buy is when the retail store is having a sale. The best time to buy real estate is when it’s cheaper than it has been in a long time. However, it is psychologically challenging to purchase property when everyone else is running away from the market. Remember, the property market will recover at some time in the future and surpass its previous peak prices.

The investment cycle helps you to sell stocks at the market peak and buy stocks at the low point of the market when stocks are much cheaper with a lower price-to-earnings ratio.

Market Cycle Action

Peak of the Cycle (Boom)

Real Estate Values Peak Sell Real Estate

Stock Values Peak Sell Stocks

High Volume of Stock & Real Estate Transactions

Economic Slowdown

Signs of Inflation

Rising Interest Rates Invest in Cash

Pay down debt

Fix Your Mortgage Rate

Falling Stock Values

Falling Commodity Values

Less Credit Supply

Tighter Lending Requirements

More Difficult to Borrow Money

Falling Real Estate Values

Real Estate Slow to Sell

Bottom of the Cycle (Bust)

Real Estate Values Bottom Buy Real Estate

Stock Prices Low Buy Stocks

Low Volume of Stock & Real Estate Transactions Good negotiating power with sellers

Economy Improving

Falling Interest Rates Lock in Fixed Deposit Rate

Rising Stock Values Hold Stocks

Rising Commodity Values

More Credit Supply

Easier to Borrow Money

Rising Real Estate Values

Real Estate Sells Quickly

Peak of the Cycle (Again)

Don’t try to perfectly time the market. Even the experts get it wrong. Instead, make your investment decisions based on where we are in the economy and what are your investment goals.

Check media reports for where we are currently in the economic cycle and determine what you course of action should be to maximize your investment opportunity.

Conclusion

I hope this post helps to explain what changes you need to make to your finances to improve your future lifestyle. The most important thing to change is your attitude toward finance, economics, and investments. You will never achieve financial independence and security with the wrong attitude towards money. Develop you long term investment strategy, implement it and remain focused on that strategy. Changing strategy in reaction to every piece of economic news will prevent you from achieving your goals. It is better to set long term investment goals and stick to your investment strategy rather than continuously changing strategy.